E&S HOME · POCKET GUIDE

Navigating E&S Home is easy. DE Forms. MEP. It’s all right here.

Policies Available In: ![]() Alabama

Alabama ![]() Florida

Florida ![]() Louisiana

Louisiana ![]() Massachusetts

Massachusetts ![]() Texas

Texas

How to Quote

START AN E&S HOME QUOTE

Begin a new quote. Enter an address and name on the Homeowners screen.

If it’s ineligible for our admitted program, you’ll likely be presented with an E&S Home quote.

Coverages and limits vary by state and program. The easiest way to determine if a risk qualifies for coverage is to start a quote. You’ll know within seconds if the home fits one of our E&S Home Programs.

Minimum Earned Premium

ALWAYS EXPLAIN HOW MEP WORKS TO YOUR CUSTOMERS

Understanding Minimum Earned Premium

Minimum Earned Premium (MEP) is part of the premium that is not refundable and it ranges from 25% to 50%. If the policy is in effect during Hurricane Season (June 1 – Nov. 30) a larger MEP could apply depending on the program. Why is this?

When Swyfft writes an E&S Home policy, we are pricing it for the perils and risk it covers. The bulk of the risk is related to covering catastrophic events, like a hurricane or tropical storm, which are much more likely to happen during Hurricane Season. The final price is a blend of the higher risk times (Hurricane Season) and lower risk times (outside Hurricane Season) in the lifecycle of the policy. If we only insured the policy during the highest risk times, the rate would be inadequate or would need to be much higher. So instead, we require MEP.

If your customers cancel early, there will be a penalty. There are some life-event exceptions such as relocations, failed closings, sale of a property and death of an insured. But as a general rule, if there’s a strong chance the customer will need to cancel the policy early, they may want to consider a different product.

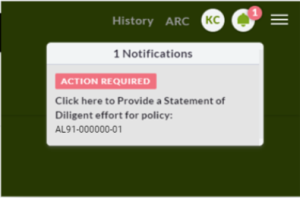

Diligent Effort

WHAT IT IS & WHY IT’S NEEDED

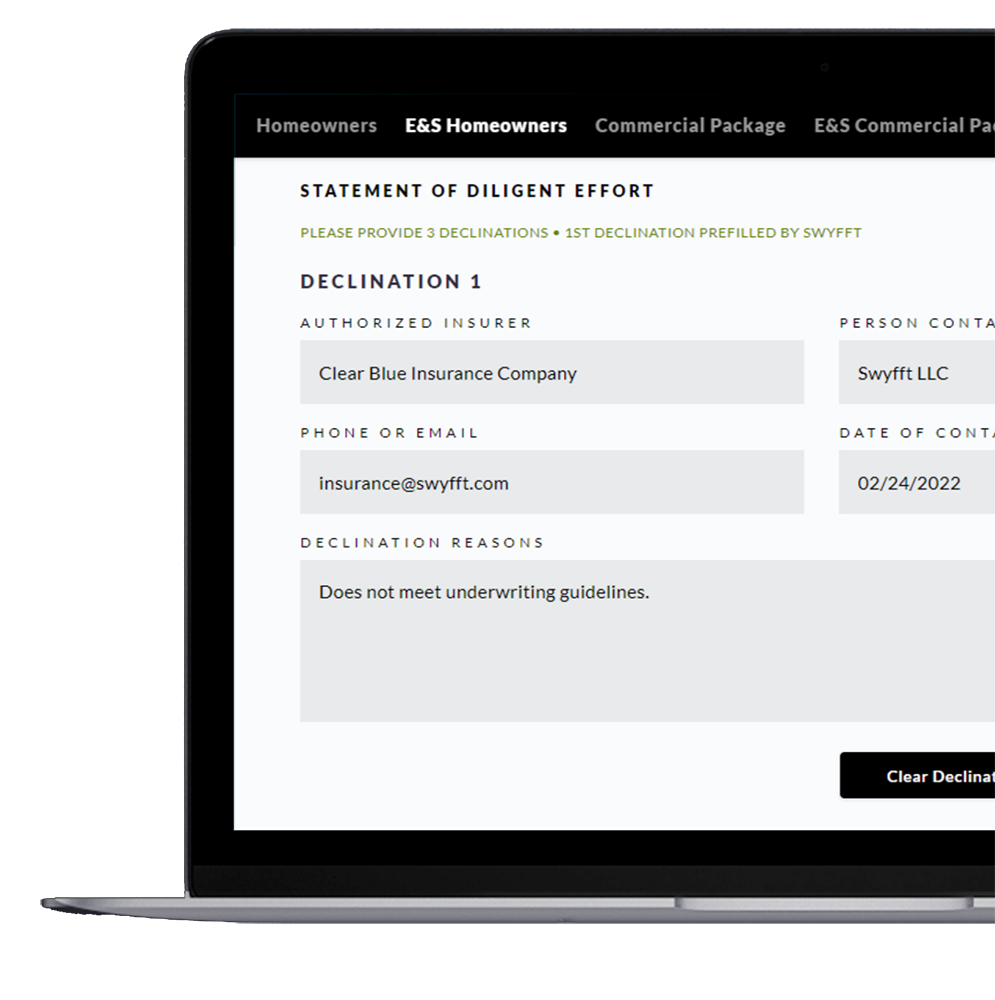

When quoting E&S coverage, most states require some form of diligent effort and/or insured affidavit. Requirements differ by state, but usually require a Diligent Effort form with a list of admitted companies that declined coverage and an affidavit stating the consumer is aware.

As such, you will be required to complete a state’s Diligent Effort and Insured Affidavit requirements when binding E&S Home coverage. Luckily, we’ve made it simple. Necessary forms for each state have been added to quoting system. You will be easily guided through a series of questions. If Swyfft declined the quote in the admitted market, that is an acceptable declination. With a few keystrokes, your diligent effort is done.

DILIGENT EFFORT REQUIREMENTS BY STATE

ALABAMA

- A Diligent Effort form is required if the risk is located north of Interstate 10. When quoting, you’ll be prompted to enter the information when the policy is bound.

- An Insured Affidavit is required no matter where the risk is located. The insured must sign an affidavit stating he/she is aware the policy is with an E&S carrier. This affidavit is provided on the bind screen for you to download, sign, then upload. A copy can also be found on the Diligent Effort page. If you do not upload the form, the policy will be canceled.

MASSACHUSETTS

- An Affidavit is required.

- Must be signed by the insured and agent.

- Must state you were unable to quote in the admitted market. You do not need to list admitted companies that declined coverage.

- Submitting the Insured Affidavit forms. When quoting, the form is provided on the quoting screen for you to download, sign, then upload. A copy can also be found on Diligent Effort page. You must upload this form or the policy will be canceled.

TEXAS

- A Diligent Effort/Affidavit is required. You must state you were unable to quote in the admitted market and provide and list 1 admitted carrier.

- Submitting Diligent Effort forms. When quoting, you will see a section to enter diligent effort info and sign. You cannot bind the policy until all information is entered.

DILIGENT EFFORT FORMS BY STATE

Payments and Fees

Payment Plan Available

- EFT, debit and all major credit cards accepted.

- Policies can be set up for escrow.

- Monthly payment plan available through Topa (also available on renewals)

- No agency bill. Direct billing only.

Fees

- $100 Inspection fee annually.

- $25 Chargeback fee for credit/debit card disputes related to a legitimate charge.

- $20 NSF fee each time payment cannot be drafted

TALK TO YOUR CUSTOMERS

5 Things to Explain When Selling E&S Home Policies

This policy has restrictions if you cancel early.

MEP means at least 25% of the premium is non-refundable once the policy is purchased. If the policy is in effect during Hurricane Season (June 1-November 30), a larger portion of the premium is non-refundable pending the program. If there’s a strong chance the customer will need to cancel the policy early, they may want to consider a different product.

Assignment of Benefits (AOB) is excluded.

While this issue predominantly impacts Florida, fraudulent activity stemming from AOB is a big driver of inflated claims costs. Let your customers know they should not sign an AOB agreement if they have a claim.

Coverage does not apply if the home is a rental.

If it’s a seasonal or secondary home, that’s okay but it must be properly winterized or protected (water shut off) if left unoccupied for more than 6 weeks at a time.

We inspect homes annually at renewal.

This helps us identify any changes in the home’s condition that might require a change to the insured’s coverage. The cost is $100 and will be billed as part of the renewal.

Coverage through Swyfft is rated A- Excellent or better by AM Best.

Swyfft only writes with financially secure companies that are rated A- or better by AM Best or A’ (Unsurpassed) by Demotech. Our E&S carriers are Lloyd’s (A-) and Topa (A’)

FAQ’S

OTHER COMMON QUESTIONS ABOUT E&S HOME

What pay plans are available?

Our E&S home product can either be full-pay or set up monthly (payment plan available through Topa).

Is escrow billing allowed?

Yes. If the account is escrowed, Swyfft will bill the mortgage/escrow company and account for the payment. You can enter this as a billing option before purchasing the policy.

What rules apply to secondary/seasonal homes?

The home cannot be a rental. Seasonal or secondary residences must be properly winterized/protected if left dormant during the off seasons.

Are you using insurance score to rate?

Yes, our E&S program does use insurance score, including credit and CLUE reports when calculating rates. We believe this will provide your customers with the best rate available.

Is Swyfft E&S Home Coverage financially secure?

Yes. Our E&S Home policies are underwritten by Lloyd’s or Topa both rated A- (Excellent) by AM Best or A’ (Unsurpassed) by Demotech.